1065 Due Date 2025. The april 15, 2025, tax returns due date: Fourth quarter estimated payments due for the tax year 2025:

All of these forms are due to the irs on. Tax season officially kicks off on january 29 this year, and federal tax returns are due on april 15th (with some exceptions).

Information about form 7004, application for automatic extension of time to file certain business income tax,.

Due date for 1065 tax return ropotqillinois, The april 15, 2025, tax returns due date: If all estimated taxes were paid by january 16, 2025, the due date for filing your return is april 15 (with some exceptions).

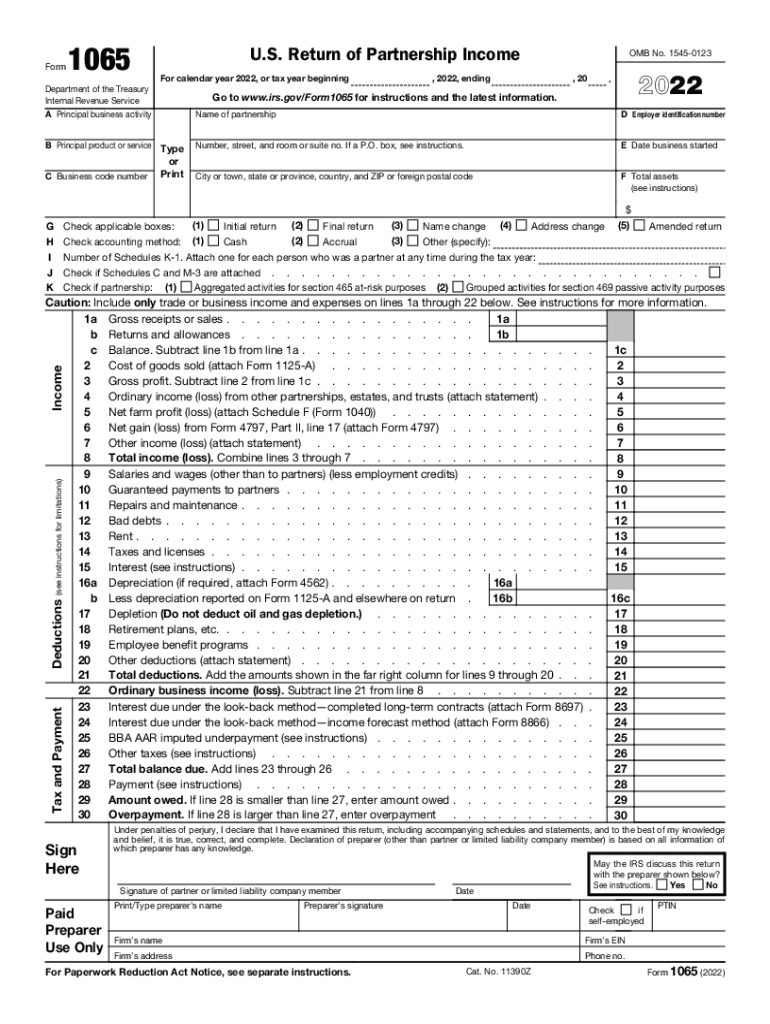

1065 20222024 Form Fill Out and Sign Printable PDF Template, Key 2025 business tax filing deadlines in 2025. Individuals who live in maine and massachusetts have until april 17, 2025, to file.

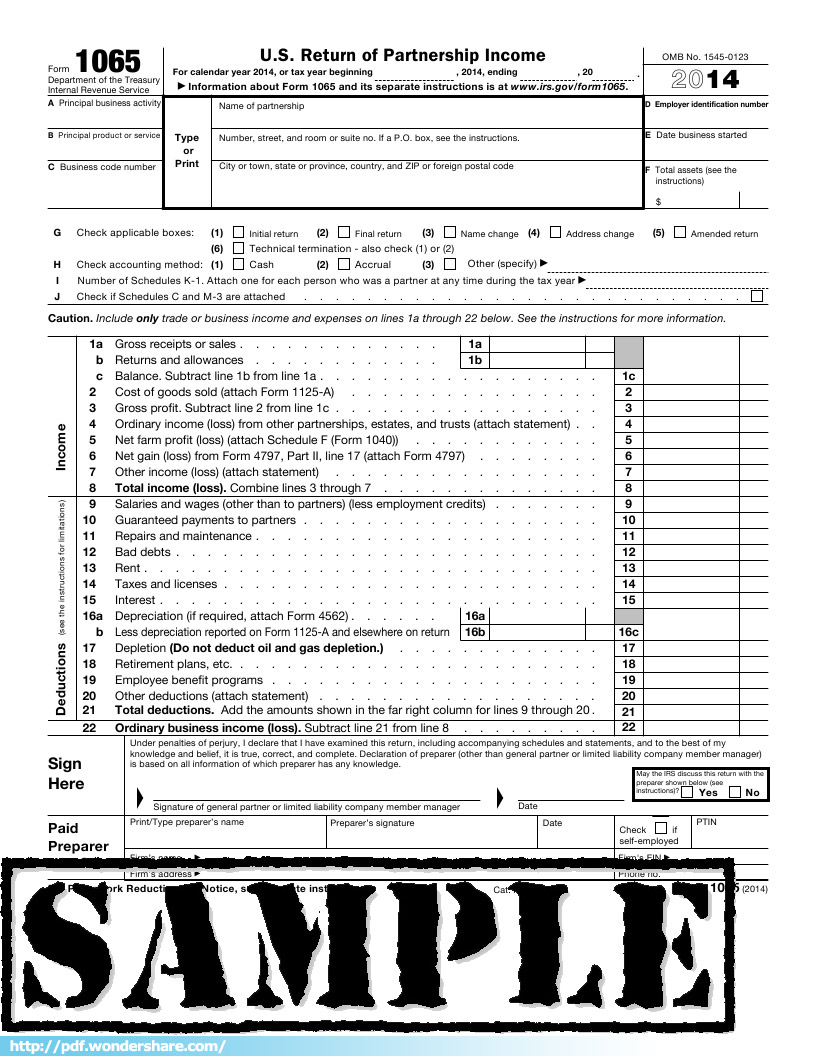

IRS Form 1065 Free Download, Create, Edit, Fill and Print, Individuals who live in maine and massachusetts have until april 17, 2025, to file. For the 2025 tax year, you can file 2025, 2025, and 2025 tax year returns.

Due dates for GST Returns (Types of GST returns), What does it mean for you? For returns required to be filed in 2025, the amount of the addition to tax under section 6651(a) for failure to file an income tax return within 60 days of.

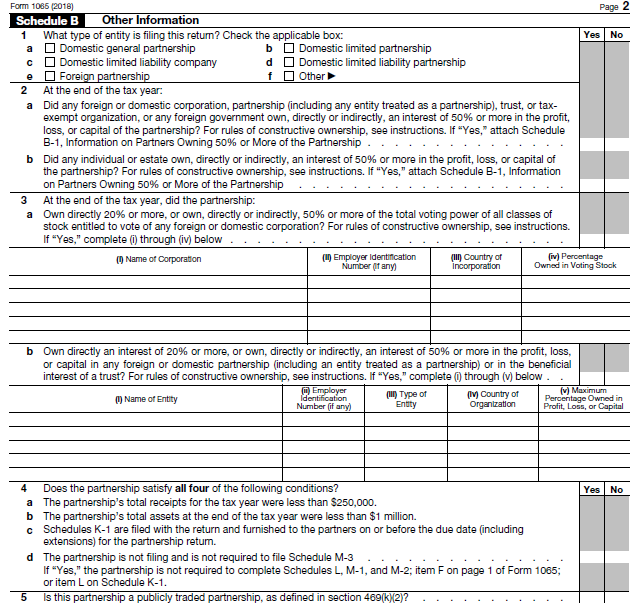

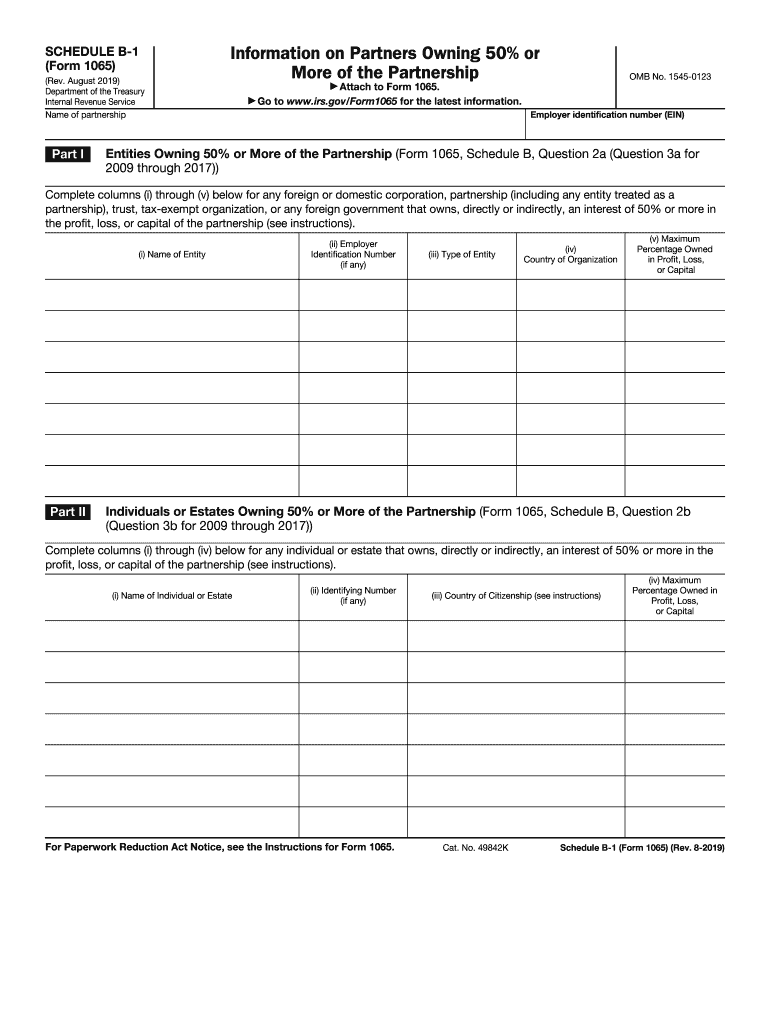

1065 Schedule B 1 20192024 Form Fill Out and Sign Printable PDF, Generally, a domestic partnership must file form 1065 by the 15th day of the 3rd month following the date its tax year ended as shown at the top of form 1065. Return of partnership income by the 15th day of the third month following the date its tax year ended.

Last Day To File Tax Extension 2025 Joye Ruthie, If you filed an extension for your s corporation or partnership, your tax return must be filed by september 16, 2025. Extended due date for residents of maine and massachusetts.

What are the Due Dates for Filing ITR Forms in AY 20232024?, Extended due date for residents of maine and massachusetts. Generally, a domestic partnership must file form 1065 by the 15th day of the 3rd month following the date its tax year ended as shown at the top of form 1065.

How to fill out an LLC 1065 IRS Tax form, For calendar year partnerships, the due date is march 15. If all estimated taxes were paid by january 16, 2025, the due date for filing your return is april 15 (with some exceptions).

2025 Tax Deadlines for the SelfEmployed, Extended due date for residents of maine and massachusetts. The april 15, 2025, tax returns due date:

Taxes Due Date 2025 Lucie Imojean, If all estimated taxes were paid by january 16, 2025, the due date for filing your return is april 15 (with some exceptions). Tax season officially kicks off on january 29 this year, and federal tax returns are due on april 15th (with some exceptions).

/balance-tax-return1-8b74d7fde2b44e5baa394d2ceda7d730.jpg)

Tax season officially kicks off on january 29 this year, and federal tax returns are due on april 15th (with some exceptions).